Authored by Charles Gave of GaveKal

Panic Stations

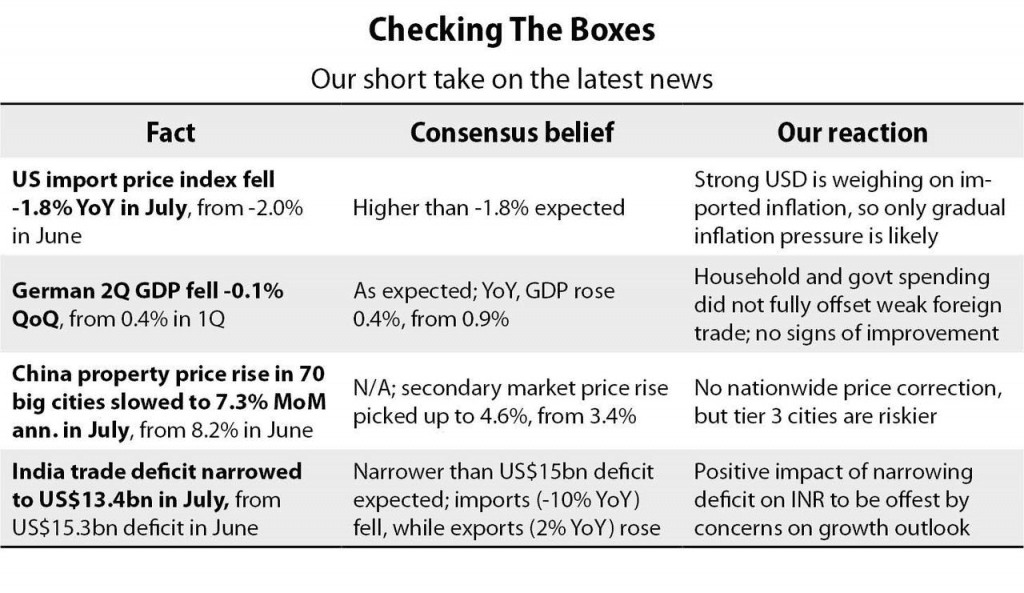

I always try to be a rules-driven investor. And when the US stock market is down -3% in a day, taking it to -6% from its peak in three weeks, when 10-year US treasury yields have halved in nine months to just 1.55%, and when gold is up 20% in three months, it is a good time to review those rules to see what they can tell me. The answer is: quite a lot.

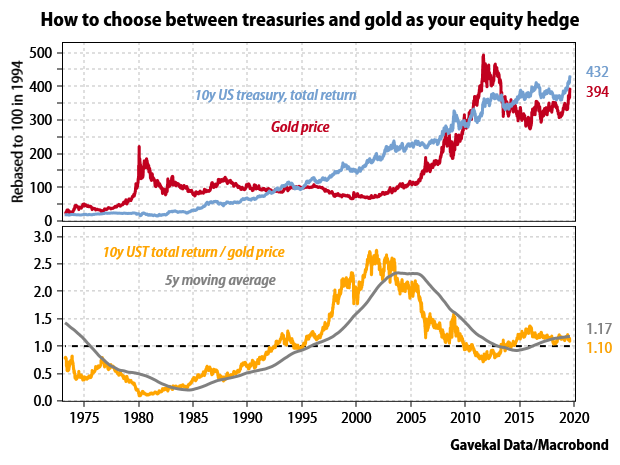

One of the core tenets of my approach to portfolio construction is that to hedge the equity portion of my portfolio, I know I can use gold if the economy is in an inflationary period, and long-dated US treasury bonds if it is in a disinflationary interlude.

The trick is to determine whether the economy is in an inflationary period or not. I tend to look at the markets. If gold has outperformed the 10-year US treasury over the previous five years, I can stop asking questions and hedge with gold. Conversely, if the bond market has outperformed, I can go ahead and hedge with long bonds, providing its valuation is not too demanding.

Now please take a look at the chart below. The upper pane shows the price of gold plotted against the total return index of the 10-year treasury. The lower pane shows the ratio of the two series. Looking at the ratio, it is clear that from 1971 to 1984, investors should have used gold as their hedge. From 1985 to 2002 they should have chosen US long bonds; then from 2003 to 2012 gold, and from 2014 to May 2019 US long bonds once again.

Since May 2019, when the treasury total return/gold ratio fell below its five-year moving average, I have been recommending that investors switch from overvalued bonds to gold as the preferred hedge for their equity exposure (see The Inflation Shift And Portfolio Construction).

Usually, these two assets—long-dated US treasuries and gold—tend to be negatively correlated. When treasuries are going up, gold tends to go down, and vice versa.

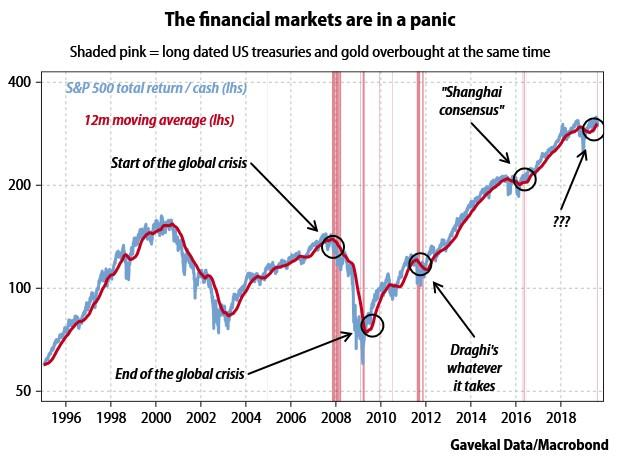

But in the last few months, both have powered ahead at the same time. This left me scratching my head, and as usual when puzzled, I reached for the history books to see when in the past both treasuries and gold have looked overbought at the same time.Specifically, I looked for other occasions when the three-month rate of change for each asset was above its respective standard deviation at the same time. The conclusion is striking: we are in a panic.

There were plenty of market panics in the 1970s, when real rates were negative. Then from 1980 to 2007, when short rates were “normal”, they were almost non-existent. However since 2007, there have been several occasions when—unusually—both treasuries and gold went up at the same time.

Here they are:

- The beginning of the global financial crisis.

- The end of the global financial crisis.

- The bond market meltdown in peripheral Europe which prompted Mario Draghi’s “whatever it takes” put.

- The slowdown in China which led to the G20 “Shanghai agreement”.

- The latest panic.

Each previous panic was dealt with by governments and—more importantly —central banks, including the Chinese central bank, ganging up to stop the rout. However, given the current chill in relations between Washington and Beijing over trade and technology, it is hard to believe that the latest episode will be halted thanks to a cozy cooperation deal between Donald Trump and Xi Jinping.

So what should investors do? My immediate advice would be to do very little right now. Acting in the middle of a panic is seldom a good idea. I would just continue selling bonds, and so raising cash.

Structurally, I maintain my call to hedge the equity risk in a portfolio with gold, since bondholders are most likely to be the victims of the next crisis. Indeed, I believe that in the next crisis, trading in some bond markets may be discontinuous, as in Argentina in recent days (see Lessons From The Argentine Shock). In the coming crisis, I fear there may be very little to choose between some European bond markets and Argentina.

Investors who believe the Hong Kong situation will not deteriorate further (see Hong Kong Q&A (Part II)) should hold on to their Chinese bonds (over the last 12 months, the 10-year Chinese government bond is up 7% in US dollar terms, handsomely outperforming the total returns on both one-year US T-bills and the S&P 500). And they should concentrate their equity holdings in high quality stocks relatively immune from the vagaries of governments, and hedge them with gold.

Praying might also help.