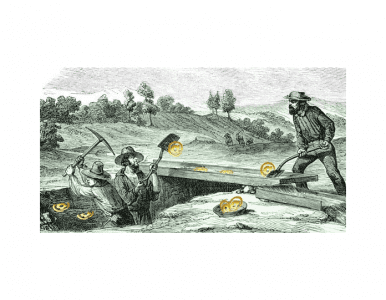

Gold rushes always inspired the masses to head west, in the case of Americans and Canadians, to get rich quick. Some of them did, but only a handful from the yellow metal itself. Far greater riches accrued to the suppliers of ,amongst other things, picks and shovels to dig the stuff out of the ground. Dawson City, current population around 1,500, was home to over 60,000 prospectors at the height of the Klondike Gold Rush. That’s a lot of picks and shovels, not to mention the other necessities that the gold seekers required. There are still a few placer mines around but the shovels are only used now to clear the snow in winter.

There is another type of “gold rush” happening right now in the beguiling world of crypto currencies. Fortunes have already been made, and lost, trading Bitcoin, Ethereum, Tether, Dogecoin et al. And the gold rush analogy doesn’t stop there. We also have bitcoin miners whose computer “farms” spend every second of the day verifying transactions and posting them to the blockchain for which they get paid in bitcoin.

The point of interest here is tied up in the blockchain software that drives this process. A blockchain is a publicly available ledger that records every transaction and cannot be altered or corrupted. So a very secure system of recording and maintaining ownership of pretty much anything. Blockchain software is evolving rapidly and it is important to note that the Bitcoin blockchain software is different from Ethereum as is Ripple and all the stablecoin derivatives.

The Bitcoin blockchain was designed solely to control the issue of and transactions in Bitcoin. Ethereum is a token just like bitcoin but its blockchain software is more adaptable and is already being used to record movements of pharmaceutical products to overcome pirating and also blood supplies for hospitals to prevent contaminated products entering the supply chain. It will be used to record share ownership and transaction and its potential applications in the banking world are legion. Abigail Johnson, the latest member of her family to become CEO of Fidelity has said, “it will fundamentally change market structures and maybe even the architecture of the internet itself.”

Many are looking on Bitcoin as digital gold and another way to play the inflation trade. It is scarce, only 21 million bitcoins will ever be “mined” (circa 19 million are currently in existence) and order flow and transactions which one might equate with velocity of money can be high. Borrowing the PT=MV formula for inflation from monetary economics Bitcoin seems to be following the same course especially as its popularity and hence flow and transactions have increased.

It is not all upside from here however, government intervention, extreme price volatility, potential hacking and fraud to name but a few put some roadblocks along the way to infinite riches. It is the applications that will be put to very profitable use from blockchain software development where the real lasting money is to be made. Microsoft was created in a garage; Facebook originally as a crude photo album. Financial applications will be a main source of development, but human ingenuity will undoubtedly open a very wide door and the investment opportunities whilst no doubt including a few Sony Betamaxes will become a very worthwhile theme for us all.