Inflation is still a big concern joined now by questions over the sustainability of the economic recovery. Emerging markets generally are flagging a slowdown in the rate of growth and whilst the numbers in the western economies look on the strong side they too are under pressure from the continuing delta variant saga. On the one hand SAGE are reported as saying the virus could mutate to a more deadly strain, fatal for 1 in 3; and in the same breath saying it may mutate into something far less toxic, which is the normal direction of travel of viruses. There is already talk of autumn lockdowns and in this climate it is not easy for businesses to formulate longer term plans.

Meanwhile the Federal Reserve are softening up the markets for the start of the tapering of quantitative easing by making changes to their repurchase and reverse repurchase agreements. This will facilitate the provision of instant (overnight) liquidity in the event of a crisis, which the announcement of tapering, for example, might generate. It will be available to overseas central banks with some notable exceptions; the People’s Bank of China being the most obvious. It will also be helpful in providing liquidity generally should equity markets swoon. So far the reverse repo facility has hit the $1 trillion mark. There is no way of knowing the unintended consequences of this move, but given the numbers involved this needs watching very closely.

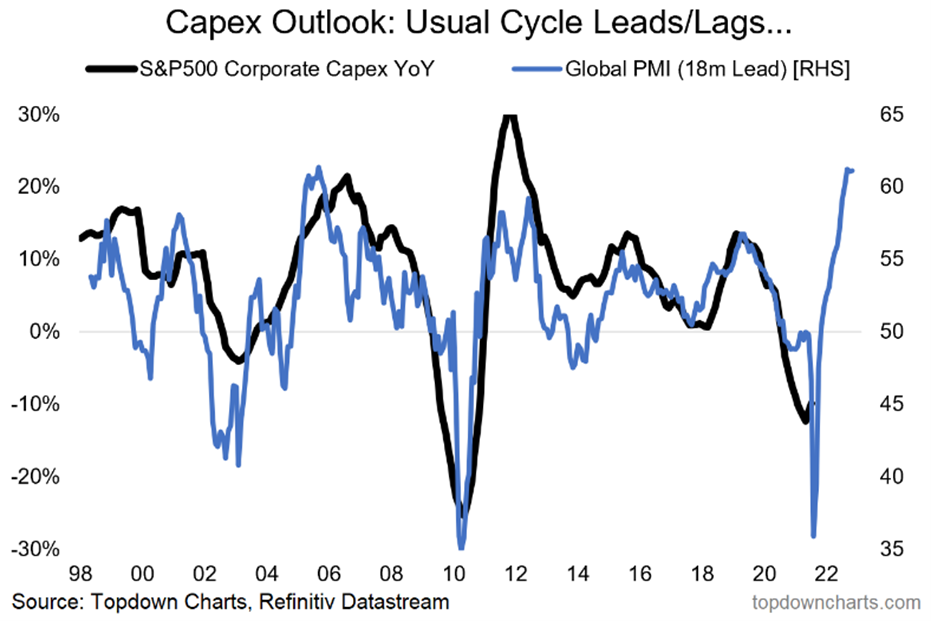

One area of the economy that should start to pick up is capex (capital expenditure). Typically what happens during the cycle is that rising demand, tightening capacity, and rising prices, all of which we are currently witnessing, send a signal to companies to expand capacity. The interesting thing is this time around we have extremely supportive financial conditions (making capex more affordable and profitable to finance but see below); and of course severe disruption of the global supply chain. That last point could cause issues in terms of actually being able to implement projects, but also intensifies the need for investment. On the other side of the affordability argument, lower rates normally suggest lower economic growth hence the dearth of capex since 2012 when “easy money” become fully imbedded in to the corporate psyche.

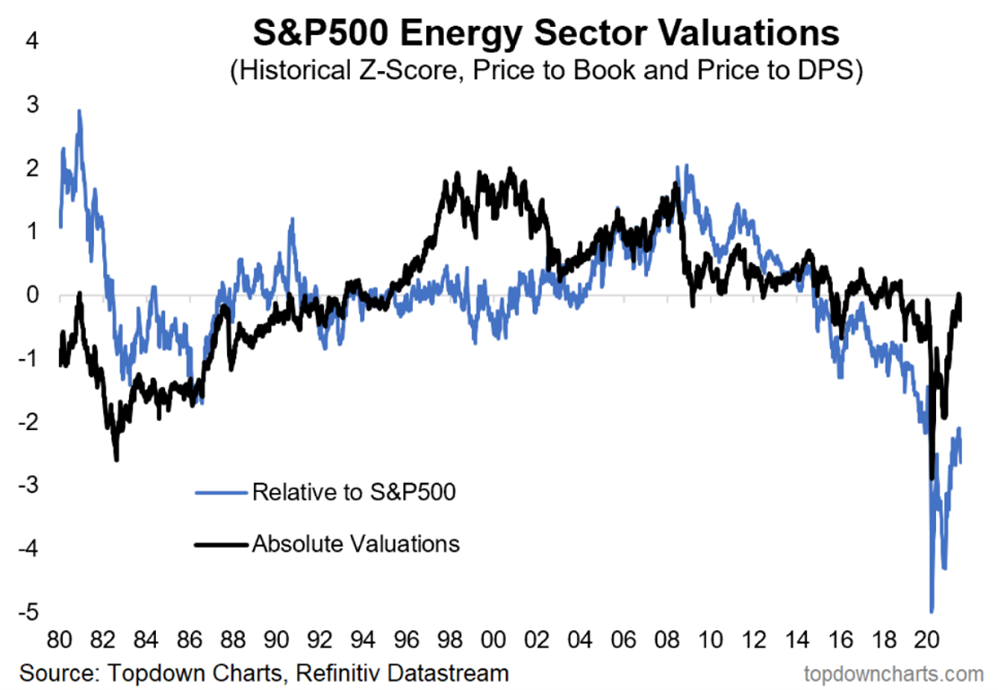

If we are entering a period of stagflation – inflation rising and growth declining – what are the themes that work in such an environment? In terms of equity sectors they are utilities, energy, quality technology, industrials and consumer discretionary, and style factors are secular growth, mid caps, low beta, momentum and quality. Credit will suffer but precious metals and commodities will be in the ascendent. Value in general will not fare well but sectors such as energy and mining which are still at relative lows may be the exception.