Deja vu all over again?

Back in 1973, the Yom Kippur war between Israel and various Middle Eastern states led to an oil embargo on the US, Japan and Europe as a result of the perceived support for Israel.

The embargo was accompanied by significant increases in the price of oil, which went up from around US$3 per barrel before the war to over US$11 per barrel by January 1974 and around US$15 per barrel by November 1974.

These developments were serious for all the major Western countries. They had particular impact in the UK where they were accompanied by a major industrial dispute in the mining industry. An industrial dispute in the electricity supply industry followed while the overtime ban was in progress and there was a further dispute on the railways.

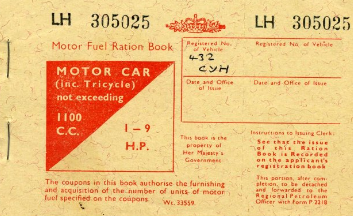

Faced with both reduced oil imports and diminishing coal supplies, the Conservative government introduced a state of emergency in December. The measures imposed under this state of emergency included a three day working week in industry, restrictions on the use of electricity and the closure of all television networks at 10.30pm. We also had petrol rationing! You had to queue for petrol with your ration book!

In the UK, it is a case of Anyone-Could-Do-Better, as fuel runs out, panic sets in, and supermarket shelves empty. Michael Every – Rabobank

The reality is that the fuel hasn’t really run out, but when anyone in government says this no one believes them and yes the “shelves empty” aided and abetted by headlines in the main stream media exacerbating the “panic”. We are predictably irrational creatures! If you want to create a shortage say there isn’t one…

In case the oil price rises look unrepeatable, don’t forget we had sub $20 oil back in 2020 and its now $75. This is a critical resistance level and a break above it could see the oil price nearer $100, which would beat the uplift in the 70s by some margin in percentage terms. Not impossible given the current demand, and likely increasing demand into Q4 as the economies in the US, Japan and Europe start to fully open up as virus cases start to tail off. In the short term the oil price move looks overextended so a pull back or consolidation is in order.

The negative correlation between cases and economic activity is a key to watch as we enter Q4. In August cases were rising and economic activity fell; as we end September cases are falling. There are still many known unknowns around that could derail markets and/or cause short term volatility; China, debt ceiling, Fed tapering et al, but a resumption of economic growth should keep the trend pointing upwards despite the “irrational exuberance”; how long that will last is anyone’s guess…